My 3rd Purchase in 2021 - 7100 UCHITEC

- cheekaan

- May 4, 2021

- 11 min read

Updated: Jun 3, 2021

It's May already, almost half a year into 2021, and today I've made my 3rd purchase of the year. After seeing the share price rally to its 52W high at RM 3.55 in 4-Mar-2021, 7100 UCHITEC has been on a small downtrend ever since and I took this opportunity to purchase a small parcel at RM 3.07, 13.5% lower than its 52W high.

“Uchi Technologies Berhad (“UCHITEC” or “the Group”) is primarily an Original Design Manufacturer (ODM) that specialises in the design, research, development and manufacture of electronic control systems which include software development, hardware design and system construction. UCHITEC takes pride in being a one-stop solutions provider with a wide spectrum of services that range from research and development, tools design and set up, and engineering support to the production of finished electronic control systems.” *taken from UCHITEC’s Annual Report 2020*

Penang based UCHITEC has a very simple corporate structure as shown above:

UCHI OPTOELECTRONIC (M) SDN BHD (UOM) - is principally involved in the design, research, development and manufacture of electronic control modules, which is the heart of UCHITEC

UCHI ELECTRONIC (M) SDN BHD (UEM) – the assembly arm of UOM

UCHI TECHNOLOGIES (DONGGUAN) CO., LTD. – the assembly arm of UOM

UCHITEC is an Original Design Manufacturer (ODM) for two different segment – Art of Living i.e., fully-automated coffee machine (85% of FY2020’s revenue) and Biotechnology i.e., electronic control systems such as high precision weighing scales, centrifuges and deep freezers (15% of FY2020’s revenue). Almost all of UCHITEC’s revenue came from Europe (97% of FY2020’s revenue).

UCHITEC’s main source of income came from its long-time partner Jura Elektroapparate AG, where UCHITEC is the sole supplier for Jura’s coffee machine. According to the 2020 Annual Report, Jura contributed approx. 77% (119,722,104 / 155,256,154) of UCHITEC’s total revenue in FY2020.

Another customer that we should take note is Eppendorf AG, the world’s leading ultra-low temperature (ULT) freezer maker based in Germany.

One thing to note is that UCHITEC is a performance driven company, as you can see plenty of performance indicators being mentioned in the Annual Report. Below is some of the key indicators which showed that UCHITEC is very serious in meeting customers’ expectations, which is an indicator for a good company.

On-time delivery rate to customers at 84.49%, compared to 57.95% in the previous year, even during the pandemic FY2020 where logistic was a big issue for all exporters around the world

Customer reject rate at 0.13% in FY2020, the 8th consecutive year where the reject rate remains below 0.20%

UCHITEC is also pretty serious in research & development (R&D), and this is really important for an ODM to stay ahead of its peers, as continuous improvement on the existing design or innovation will lead to better product and hence better profit margin. UCHITEC has a policy which they will allocate 7% of their revenue in R&D each year, which is RM 4 million for FY2020.

For their past financial performance, the graph above showed that UCHITEC managed to record impressive growth since FY2013, with its Profit After Tax (PAT) recording a 11.5% CAGR from FY2013 to FY2020. They did pretty well in the FY2020, recorded 10.4% increase in PAT compared to FY2019, even though the entire world was affected by the COVID-19 virus. FY2020’s profit margin stood at a very impressive high level at 53.95%, due to UCHITEC being the ODM, which owns the design of the products they produced.

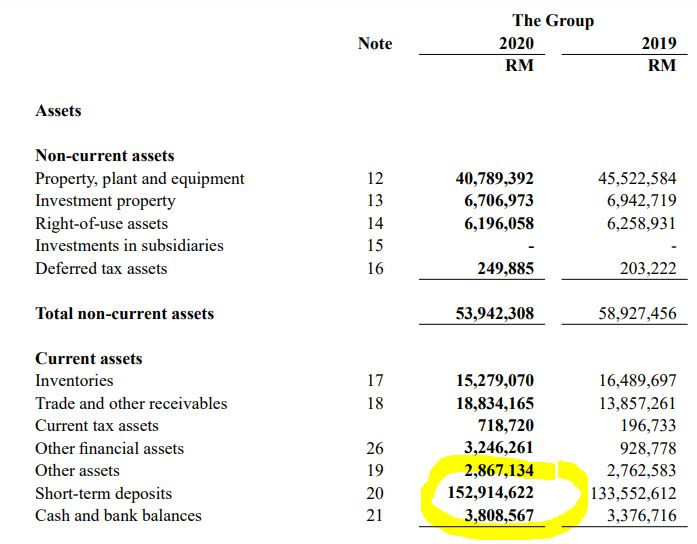

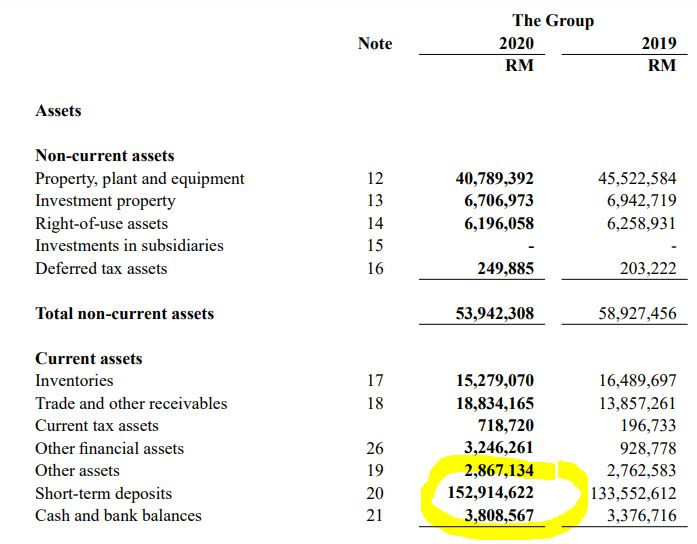

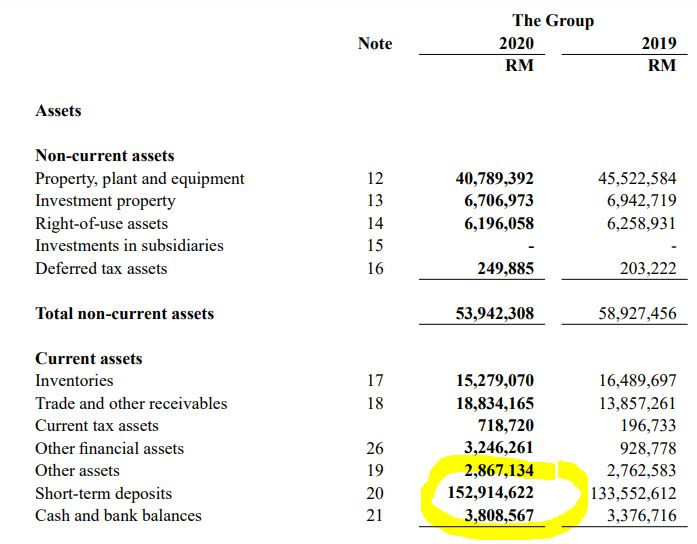

As for their balance sheet, UCHITEC is a debt free company, currently holding a cash of RM 156.7 million, a 14.5% increase compared to the previous year at RM136.9 million. That’s equivalent to approximately RM 0.345 of cash per share. It’s pretty safe to say the company will be able to withstand even the worst business downturn.

Cash flow looks pretty impressive too, as the company managed to have a positive cash inflow of RM 20 million, with net cash generated from operations amounting to RM 85.7 million, representing 107% of the PAT.

The followings are the reasons why I decided to invest in UCHITEC:

1. Impressive growth in both revenue and net profit from 2013-2020, with a super high ROE and profit margin. Revenue grew 65.21% in 8 years, averaging 8.15% per year, net profit grew 114.32%, averaging 14.29%. Profit margin is improving from low 40% to near 50%. The ROE is extremely high compared to other companies in Bursa, shows that the company is managed efficiently by a very capable management team. Please take note the ROE jumped to 40+% in FY2018 because UCHITEC pay out a big 25cent dividend for FY2017, thus reducing the shareholder’s equity. Even so, UCHITEC still recorded a near 20% ROE from FY2013 to FY2016.

2. Long term partnership with Jura. As mentioned above, UCHITEC is the sole supplier for Jura’s coffee machine. Not only that, UCHITEC also partner with Jura in R&D to invent new products with new technology. By doing so, UCHITEC is able to enjoy hefty profit margin (around 50% as shown above). It’s not easy to find another company that has this kind of profit margin, which shows that this synergy with its customer is really beneficial to UCHITEC.

3. Strong demand for automated coffee machine in Europe. Coffee is considered the default beverage for Europeans, much like what Milo is to Malaysians. Furthermore, the lockdown caused by the pandemic has resulted in high demand for automated coffee machines, especially the household demand, due to the work-from-home requirement. This can be seen by the sales of Jura’s coffee machines from 398,000 to 448,000 units, a 12.56% increase from FY2019 to FY 2020. Jura CEO Emanuel Probst anticipated that 500,000 units will be sold for FY2021. If that’s the case, that’s 11.6% increase. Furthermore, Jura will be launching the brand new Z10 coffee machine, which is capable of brewing full range of hot-brewed coffee and cold-brewed specialties using the espresso method. I believe this brand-new model will be an earning catalyst for UCHITEC.

Source:

4. Potential growth for the Biotechnology segment. As highlighted by Hong Leong Investment Bank (HLIB) Research, UCHITEC produces ultra-low temperature and mass sensing control system, which is designed for the storage biological materials (such as virus, bacteria, eukaryotic cells, stem cell and blood) mainly used in blood banks, hospitals, epidemic prevention services, research institutes and biomedical facilities. Affin Hwang Capital has the same opinion on this matter too.

Link:

5. High dividend yield with a 70% PAT pay out policy since 2003, and zero debt. Total dividend announced for FY2020 stood at 17 cent, that’s 91% of PAT, translating to a dividend yield of 5.48% based on today’s closing price at RM 3.10. Furthermore, UCHITEC has the history of paying massive dividend to reduce its shareholder’s equity (25cent dividend in FY2017).

6. Share price trading at P/E 16-ish, with possible high earning growth for FY2021. As mentioned above, Jura is expected to sell 500,000 units of coffee machines in FY2021, +11.6% YoY. Assuming this translate to a 9% increase in UCHITEC’s revenue, UCHITEC is estimated to record RM 170 million in revenue in FY2021. Assuming the same profit margin at 52%, PAT will be RM 88 million, i.e. 19.37cent EPS. By referring to HLIB’s P/E 19x and Affin Hwang’s P/E 21x, I’m assuming a modest P/E 18x which translate to RM 3.49.

7. An outstanding company with various recognition. UCHITEC made the headlines twice in year 2020 - winning the Highest Return on Equity over three years award for the Industrial Products & Services sector under The Edge Billion Ringgit Club Corporate Awards and being named in the Forbes Asia’s Best Under A Billion 2020 list. Only 15 Malaysian companies were included in this prestigious list, which highlights 200 Asia-Pacific public companies with less than US$1 billion (RM4.19 billion) in revenue but consistent top- and bottom-line growth. These recognitions shows that UCHITEC is very well managed with strong corporate governance and committed to create sustainable value for all shareholders.

Link:

The following concerns I had with UCHITEC:

1. Major client concentration. As shown above, Customer A (which is very likely to be Jura) contributed 77% of UCHITEC’s FY2020 revenue, while Customer B contributed 9.45%. These two customers combined to made up 86.45%. Losing anyone of them (especially Jura, but it’s highly unlikely) will be disastrous to the company.

2. USD depreciation against MYR. With almost all of UCHITEC’s revenue is denominated in USD, the weakening of USD will definitely affect UCHITEC’s bottom line.

Conclusion: With plenty of upsides and limited downside, I think UCHITEC is quite a safe company to invest in. Furthermore, due to a recent sell down, I believe the entry at RM 3.07, P/E of 16-ish is not too high for a company that has zero debt, with extremely high ROE and profit margin, and respectable dividend yield (>5%). I’m expecting UCHITEC to command at least P/E 18, which translate to RM 3.49 (based on estimated FY2021 EPS of 19.37cent), and a potential 5% dividend yield. This sums up to be a potential +18% gain. A pretty good deal for me.

Note: All the above information can be found in the latest FY2020 Annual Report here:

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=207075&name=EA_DS_ATTACHMENTS

Disclaimer: This is a personal opinion recorded for my personal record. Nothing on this Blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product, transaction or investment strategy is suitable for any specific person. The author shall not be held accountable for any investment decision made by the reader. Invest at your own risk.

一转眼就已经5月了,今天我做出了今年第三次的买入。 7100 UCHITEC的股价在2021年3月4日上升至全年最高位的RM 3.55后便一直处于下跌趋势,所以我借此机会以比全年最高价位低13.5%的RM 3.07价位买入少数的股。

"宇琦科技(Uchi Technologies Berhad)主要是原始设计制造商(ODM),专门从事电子控制系统的设计,研究,开发和制造,其中包括软件开发,硬件设计和系统构建。 宇琦科技以成为一站式解决方案提供商而感到自豪,其提供的服务范围涵盖研发,工具设计和设置以及工程支持到成品电子控制系统的生产。" *摘自宇琦科技2020年度报告*

如上图所示,位于槟城的UCHITEC的公司结构相当简单:

UCHI OPTOELECTRONIC (M) SDN BHD (UOM) - 主要从事电子控制模块的设计,研究,开发和制造,是UCHITEC的核心

UCHI ELECTRONIC (M) SDN BHD (UEM) – UOM的组装臂

UCHI TECHNOLOGIES (DONGGUAN) CO., LTD. – UOM的组装臂

UCHITEC是两个领域的原始设计制造商(ODM):生活艺术,即全自动咖啡机(占2020财年收入的85%),和生物技术,即电子控制系统,如高精度秤,离心机和深层冷冻机( 2020财年收入的15%)。 UCHITEC的收入几乎全部来自欧洲(2020财年收入的97%)。

UCHITEC的主要收入来源来自其长期合作伙伴Jura Elektroapparate AG,而UCHITEC是Jura咖啡机的唯一供应商。根据2020年年度报告,Jura贡献了UCHITEC总营业额的大约77%。(119,722,104 / 155,256,154)

另一个我们应该关注的客户是来自德国的Eppendorf AG,是世界级的超低温冷冻机制造商。(链接: https://www.thestar.com.my/business/business-news/2021/02/20/uchis-vaccine-storage-play)

其中一点值得注意的是UCHITEC是一间以绩效为导向的公司,您可以从其年报中看到各种不同的绩效指标。以下的一些关键指标显示UCHITEC在满足客户期望方面非常重视,这是一个好公司的特点。

按时交货给客户的比率仍为84.49%,去年则是57.95%。这是在疫情充斥下,全球出口商在物流方面都面临艰难挑战的2020年达成的。

2020财年客户拒绝率为0.13%,连续第八年保持在0.20%以下。

UCHITEC在研发方面也很认真,这有助于保持其ODM的优势和地位,因为对现有设计不断的改进或创新将带来更好的产品,从而带来更高的利润。 UCHITEC的研发政策确保每年将分配总值相等于年收入7%的资金作为研发资金,而2020财年则为400万令吉。

就公司的营业表现来看,上图显示UCHITEC的营业额和净利自2013年以来每年都有不错的增长,其中税后净利更是在2013至2020年期间取得11.5%的复合年增长率。2020财年表现也相当不错,即使在疫情笼罩之下税后净利也比去年增长10.4%。2020财年的利润率高达惊人的53.95%,主要因为UCHITEC是拥有其产品设计的ODM。

至于资产负债表,UCHITEC是一家零债务公司,目前持有RM 1.567亿现金,较上年的RM 1.369亿增长14.5%,相当于每股约RM 0.345现金,可以说UCHITEC应该可以在最糟糕的环境下都能度过难关。

现金流也相当健康,因为公司取得了RM 2000万的正现金流入,运营产生的净现金达RM 8570万,占了税后净利的107%。

以下是我觉得买入UCHITEC的原因:

1. 从2013年至2020年,收入和净利润均取得惊人的增长,股本回报率和利润率均超高。收入在8年中增长了65.21%,平均每年增长8.15%,净利润增长了114.32%,平均增长了14.29%。利润率从约40%提高到接近50%。与其他上市公司相比,UCHITEC的股本回报率极高,这表明该公司由一支非常有能力的管理团队进行高效管理。要注意的是,股本回报率在2018财年跃升至40%以上,因为UCHITEC在2017财年支付了RM 0.25的高额股息,从而减少了股东资本。即便如此,UCHITEC在2013财年至2016财年的股本回报率仍然接近20%。

2. 与Jura的长期合作关系。如上所述,UCHITEC是Jura咖啡机的唯一供应商。不仅如此,UCHITEC还与Jura合作进行研发,以采用新技术发明新产品。因此UCHITEC可以享受丰厚的利润率(如上图所示,约为50%)。股市中很难找到另一家拥有这种利润率的公司,这表明与客户的这种互惠互利的合作确实对UCHITEC相当有利。

3. 欧洲对自动咖啡机的强劲需求。咖啡对于欧洲人而言Milo对马来西亚人而言一样,几乎相等于必须品。此外,由于疫情的关系而必须居家工作导致自动咖啡机的需求提高,尤其是居家需求。因此Jura的咖啡机销量从398,000台增至448,000台,比2019财年增长了12.56%。Jura首席执行员Emanuel Probst预计2021财年将售出500,000台的咖啡机,相等于11.6%的增长。此外,Jura还将推出全新的Z10咖啡机,该咖啡机能够使用意式浓缩咖啡方法冲泡全系列的热煮咖啡和冷煮咖啡。我相信这种崭新的咖啡机将成为UCHITEC的盈利催化剂。

链接:

4. 生物技术领域的潜在增长。正如丰隆投资银行(HLIB)所强调的,UCHITEC生产的超低温和质量传感控制系统适用于存储血库,医院,防疫服务,研究所和生物医学设施有关的生物材料(例如病毒,细菌,真核细胞,干细胞和血液)。Affin Hwang Capital有保有相同的看法。

链接:

5.自2003年以来股息率相当高,税后净利70%的股息派发政策,零债务。 2020财年宣布的总股息为RM 0.17,相当于税后净利的91%,按今天的收市价RM 3.10计算,股息率为5.48%。此外,UCHITEC有支付巨额股息以减少其股东资本的历史(2017财年股息为RM 0.25)。

6. 本益比大约16,2021财年可能会有较高的盈利增长。如上所述,Jura预计将在2021财年销售500,000台咖啡机,同比增长11.6%。假设这能够带动UCHITEC的收入增加9%,那么UCHITEC预计在2021财年将创收RM 1.7亿。假设利用52%的利润率,那么税后净利将达到RM 8800万,即每股收益19.37c。通过参考HLIB的P/E 19x和Affin Hwang的P/E 21x,我预测P/E 18x,即相等于RM 3.49。

7. 一家获得广泛认可的优秀公司。 UCHITEC在2020年两次登上新闻 - 荣获The Edge Billion Ringgit Club Corporate Awards颁发的工业产品和服务领域三年内最高股本回报率奖,并入选福布斯亚洲2020年最佳十亿以下企业榜单。该榜单仅纳入15家马来西亚公司,主要是记录200家收入低于10亿美元(41.9亿令吉)但营业额和营业额均保持稳定增长的亚太上市公司。这些认可显示UCHITEC管理完善,拥有强大的公司治理,致力于为所有股东创造可持续的价值。

链接:

我对UCHITEC的担忧有以下几点:

1. 主要客户过于集中。如上所示,客户A(很有可能是Jura)贡献了UCHITEC 2020财年收入的77%,而客户B则贡献了9.45%。这两个客户合计占了总营业额的86.45%。失去他们其中任一个(尤其是Jura,但可能性不高)将会给公司造成灾难性的后果。

2. 美元兑马币贬值。由于UCHITEC几乎所有的收入均以美元计算,美元贬值无疑会影响UCHITEC的利润。

总结:鉴于上行空间很大,下行空间有限,我认为投资于UCHITEC是相当安全的。此外,由于最近的抛售,我相信以RM 3.07的价格进入一家零负债,ROE和利润率极高且股息收益率可观(> 5%)的公司,本益比16倍并不太高。我预计UCHITEC至少要应该有18倍的本益比,即相当于RM 3.49(预测2021财年的每股收益为19.37c),以及潜在的5%股息率。这相等于大约18%的潜在回酬,对我而言是相当不错的回酬。

免责声明:这只是个人意见,记录下来供我个人使用。此博客上的任何内容均不构成投资建议,绩效数据或任何建议,任何证券,证券组合,投资产品,交易或投资策略均适合任何特定人士的建议。作者对读者做出的任何投资决定概不负责。投资风险自负。

Comments